wells fargo class action lawsuit fake accounts

Wells Fargo is reinstating some recruiting guidelines in the wake of a New York Times story that the bank conducted fake interviews of job candidates to prop up diversity efforts. DETAILS OF THE CASE.

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

. If you are an Eligible Settlement Class Member with an uncashed Settlement Payment you may still claim your payment. Add me to this class action lawsuit please Ive been with T-Mobile for ten plus years and in my area is a dead zone for 3g 4g 5g service. T-Mobile Lawsuit over Unauthorized Accounts.

According to the lawsuit defendants throughout the Class Period made false andor misleading statements andor failed to disclose that. Citigroup owns Citicorp the holding. Wells Fargo Unauthorized Accounts Settlement PO.

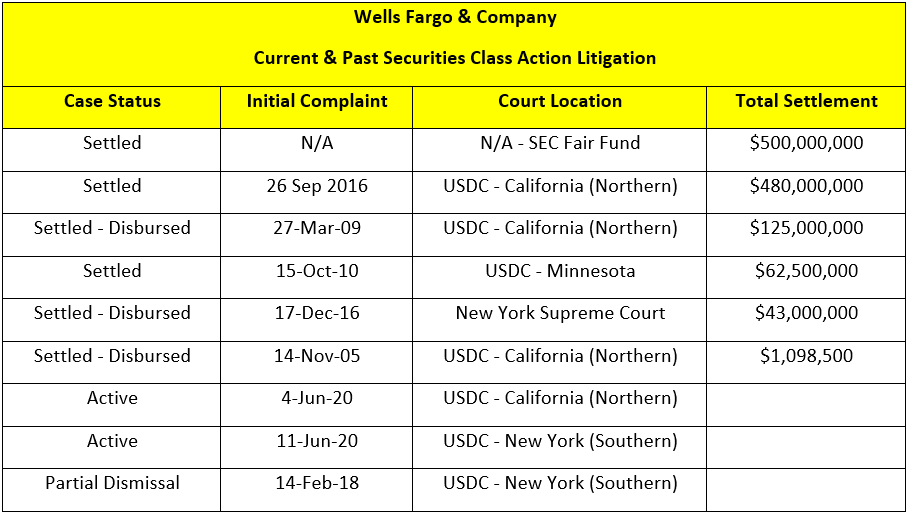

Wells Fargo Overdraft. 480 million to settle securities-fraud lawsuit. In December 2018 the company settled with 50 state attorneys general to resolve civil claims for cross-selling auto lending and mortgage lending violations and agreed to pay 575 million.

In the wake of the fake account scandal. Wells Fargo Unauthorized Account Settlement. ROSEN A LEADING LAW FIRM Encourages Wells Fargo Company Investors to Secure Counsel Before Important Deadline in Securities Class Action - WFC PRESS RELEASE PR Newswire Jul.

It reported 2016 net revenue of 8827 billion and net income of 204 billion or 399 per share with nearly 2 trillion in. Wells Fargo paid nearly 36 million to about 320 members of the class-action lawsuit and pledged to take actions designed to enhance opportunities for employment earnings and advancement of. Two weeks later it agreed to pay 480 million to settle a securities class action lawsuit over cross-selling.

Bank customers recently filed class action lawsuits against Capital One Bank of America Wells Fargo Navy Federal Credit Union and Zelle. WFC between February 24 2021. Inovio Pharmaceuticals has agreed to settle a shareholder class action lawsuit which alleged the Plymouth Meeting biotech company made false and misleading statements about the development of a.

Zelle fraud class action lawsuits overview. Wells Fargo. 1 Wells Fargo had misrepresented its.

Operational headquarters in Manhattan. In July 2017 Wells Fargo agreed to pay 142 million to its customers in a settlement over the 35 million potentially fake accounts the bank admitted to opening without their permission. It is considered a systemically important.

Or Citi stylized as citi is an American multinational investment bank and financial services corporation headquartered in New York CityThe company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998. NEW YORK Aug. I had T Mobile phones plus ATA and Direct For over 15 years I know I was over charged with these accounts.

Their case one of the few filed before the bank admitted last year to creating millions of potentially unauthorized accounts led to a. The company has operations in 35 countries with over 70 million customers globally. The agreement means a payout for any account holders affected by the scandal all of whom were given about nine months to file for reimbursement.

Can I file a Class Action Lawsuit against T-Mobile. The Wells Fargo account fraud scandal is a controversy brought about by the creation of millions of fraudulent savings and checking accounts on behalf of Wells Fargo clients without their consent. 9 2022 PRNewswire --.

According to the lawsuit defendants throughout the Class Period made false andor misleading statements andor failed to disclose that. Verizon and T-Mobile have recently faced class action lawsuit claims over accessibility service and billing issues. Curtis Simpson August 7 2022 I was a Verizon customer back in 2008 and 2009.

1 Wells Fargo had misrepresented its. 1 Wells Fargo had misrepresented its. Get 247 customer support help when you place a homework help service order with us.

Rosen Law Firm a global investor rights law firm reminds purchasers of the securities of Wells Fargo Company NYSE. In recent years B2B organizations have added more and more XDRs but outcomes havent kept up with expectations. According to the lawsuit defendants throughout the Class Period made false andor misleading statements andor failed to disclose that.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. 24 2022 0114 PM. What is a Class Action Lawsuit.

Dropped calls no data staticky calls and its so irritating to keep calling them for them to only tell me nothing that works even had to purchase a Wi-Fi router which doesnt work. Customers claim the financial institutions do not do enough to protect them from fraudulent activity on Zelles digital peer-to-peer payment platform. In a class action suit Wells Fargo agreed to pay 142 million to the affected.

In this white paper we look at findings from recent TenboundRevOps SquaredTechTarget research to identify where major chronic breakdowns are still occurring in many Sales Development programs. Wells Fargo can afford to pay. In early 2019 T-Mobile was facing litigation for charging a non-customer of the company for simply getting a quote for phone services bringing back memories of the Wells Fargo fake account scandal.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. And managerial offices throughout the United States and internationally. DETAILS OF THE CASE.

News of the fraud became widely known in late 2016 after various regulatory bodies including the Consumer Financial Protection Bureau CFPB fined the company a combined. In May a. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

DETAILS OF THE CASE. Travelers was subsequently spun off from the company in 2002. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

Wells Fargo Forced To Pay 3 Billion For The Bank S Fake Account Scandal

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo Facing Class Action Over Zelle Scams Pymnts Com

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Settles 480m Class Action Brought By Investors Philadelphia Business Journal

Wells Fargo Still Faces Over A Dozen Probes Tied To Fake Account Scandal

Wells Fargo Unauthorized Accounts Class Action Settlement Top Class Actions

Wells Fargo Employees Pushing To Organize Union Across Bank S Workforce Wells Fargo The Guardian

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Fired Wells Fargo Workers File Federal Class Action Lawsuit Seeking 7 2 Billion Fargo Wells Fargo Bank Branch

Wells Fargo To Pay 3b To U S To Settle Fake Accounts Scandal

Wells Fargo Reaches 3 Billion Settlement Over Fake Accounts Scandal The Washington Post

Wells Fargo Fraud Ethics Unwrapped

Wells Fargo To Pay 3 Billion Over Fake Account Scandal

American Regulators To Wells To Fargo This Is Unacceptable Cnn